Navigating through the mortgage options in today’s market can be a bit difficult…

Purchasing a home is always a significant milestone in one’s life, and finding the right mortgage strategy can make a world of difference. In this article, we will explore some of the best mortgage strategies or “hacks” for today’s home buyers. We’ll discuss interest rates, hard money loans, and even take a look at the history of interest rates to forecast what lies ahead in the next two years. Additionally, we’ll delve into the concept of seller contributions to buy down the interest rate, including the 2-1 interest rate buy down and 3-2-1 programs.

Understanding Interest Rates:

Interest rates of course play a crucial role in determining the cost of borrowing for a mortgage. When rates are low, home buyers have the opportunity to secure more favorable terms, reducing their overall expenses over the life of the loan. Conversely, higher interest rates increase borrowing costs and may limit affordability.

Exploring Hard Money Loans:

A hard money loan is most often a form of short-term financing typically offered by private investors or investment companies, often referred to as hard money lenders. Hard money loans are secured by the property and are known for their fast approval process and flexible terms. Hard money loans are an option worth considering, particularly for home buyers facing unique circumstances. While hard money loans may have higher interest rates, larger down payments and shorter repayment periods, they can be an effective solution for buyers with less-than-ideal credit, certain self-employed individuals, or those seeking quick financing for distressed properties or fixer-uppers.

Seller Contributions to Buy Down Interest Rates:

This is a common offering from many homebuilders, additionally you will find some resellers in more competitive segments of the market willing to make seller concessions to buy down the interest rate as well. This strategy involves the seller contributing funds towards permanently reducing the interest rate on the mortgage loan. By doing so, the buyer can enjoy lower monthly payments and potentially save a significant amount of money over the life of the loan.

The 2-1 Interest Rate Buy Down:

Another popular approach is the 2-1 interest rate buy down program. With this strategy, the seller contributes enough funds to temporarily reduce the interest rate by 2% for the first year and 1% for the second year. This allows the buyer to enjoy more affordable payments during the initial years of homeownership. After the initial period, the interest rate returns to its original level.

The 3-2-1 Program:

Yet another option is the 3-2-1 program, which follows a similar principle. In this case, the seller contributes enough funds to lower the interest rate by 3% in the first year, 2% in the second year, and 1% in the third year. This gradual reduction in interest rates provides home buyers with incremental savings over a longer period.

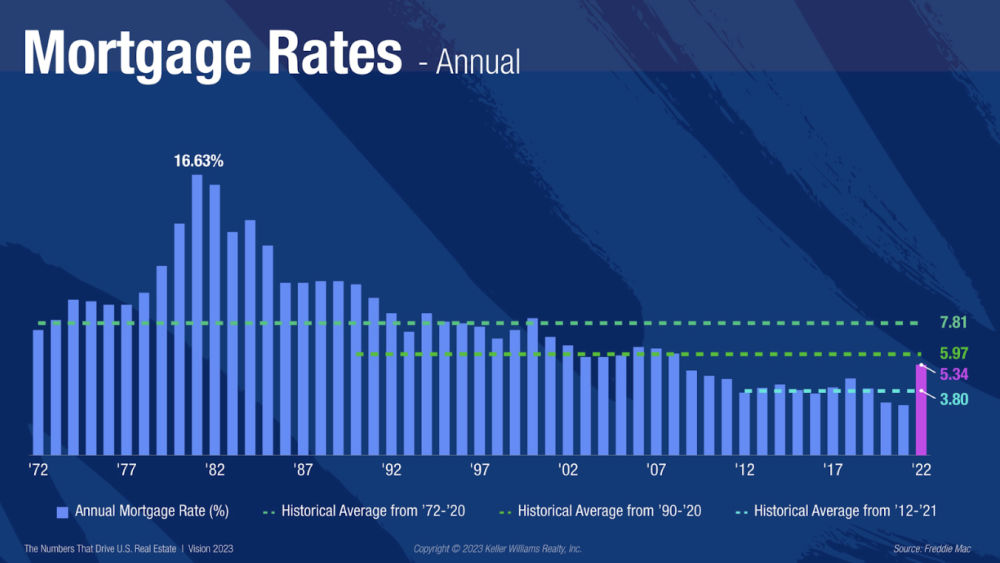

A Historical Perspective on Interest Rates:

Taking a look at the history of interest rates can provide valuable insights for today’s home buyers. In recent years government stimulus as well as low inflation pressure held rates at artificially record low levels. Today’s interest rates, while by comparison feel high, are actually just above the 20 year historical average of 5.97% (see chart above).

Forecasting Interest Rates:

While predicting interest rates with absolute certainty is challenging, some indicators can help forecast future trends. Economic indicators, such as employment rates, GDP growth, and inflation, can provide clues about the direction of interest rates. Additionally, closely monitoring central bank policies and statements can offer insights into their stance on monetary policy. As your real estate adviser I monitor these factors and can provide up-to-date information and guidance based on current market conditions.

Looking Ahead:

As we peer into the crystal ball, the next two years are expected to bring moderate increases in interest rates. However, it is crucial to remember that these forecasts are subject to change as economic conditions evolve. Home buyers should remain vigilant, stay informed, and be prepared to adjust their strategies accordingly.

Conclusion:

In today’s dynamic mortgage landscape, home buyers have an array of strategies and options to consider. Understanding interest rates, the impact of buy downs, and exploring alternatives like hard money loans can help buyers make informed decisions. By keeping a pulse on historical trends and staying updated on economic forecasts, home buyers can position themselves to secure the best possible mortgage terms. Remember, a well-crafted mortgage strategy is the key to unlocking the door to your dream home.

Today’s market offers unique opportunities for savvy home buyers and sellers. Should you have any plans to make a move in the next 12-24 months please contact me to schedule a no-obligation strategy session.